Table of Contents

What do budgeting apps do?

A good app for budgeting will help you track your personal finances on the go and make sure you have the complete picture of what you are bringing in versus how much you are spending. Some apps for money budgeting can also help you track your credit card balances and all of your bank balances. Typically you can set up categories for your expenses to keep things organized. They can also help you set up goals for saving and debt payoff.

Are budgeting apps safe?

The short answer is yes. If you are choosing a good budgeting app, most have appropriate security and encryption safeguards in place to protect your private information. You can read this article from US News on “How Safe Are Budget Tracking Apps” where they break down some of the top apps for budgeting and what exactly they are doing to protect your information. Obviously, it is still always good to double-check that you are using good strong passwords and that the personal budgeting app that you choose is reputable.

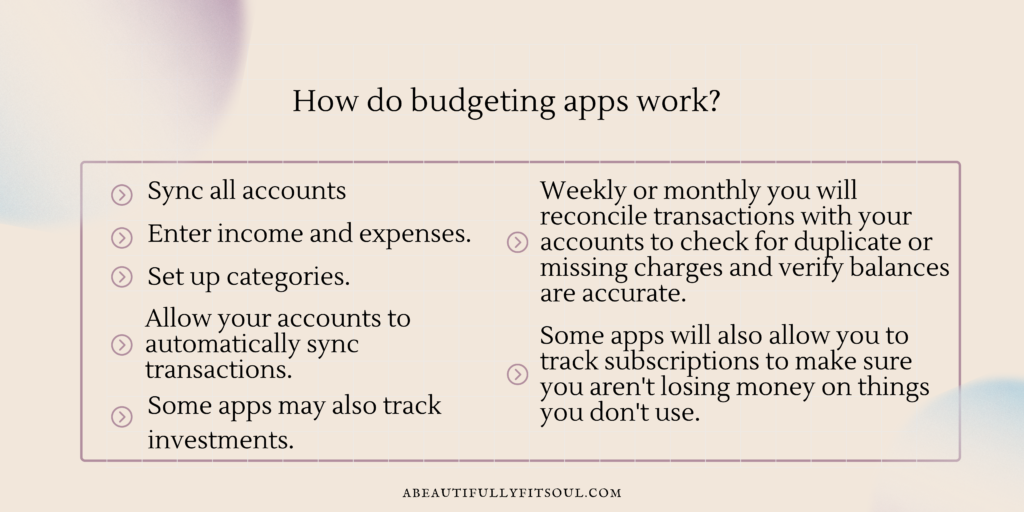

How do budgeting apps work?

Good apps for budgeting will have you sync up your accounts and enter your income and expenses. You can set up your various categories and different savings or debt payoff goals. Once you have everything set up and connected going forward, the app will automatically upload transactions for you from whichever financial institutions you have connected to. You will want to take time periodically to reconcile everything between the app and your banking accounts to make sure all of your transactions have been uploaded correctly and have gone to the correct categories. Make sure there are no duplicate charges or missing charges, so you have the correct picture of where you are at!

Tracking Subscriptions

Some budgeting money apps can keep track of your subscriptions so you can make sure you aren’t paying monthly for something you weren’t aware of or that you don’t even use.

Apps Vs. Tracking Bank Statements

I feel budgeting apps are much more helpful than just looking through your bank account for a few reasons. First of all, having the charges divided into different categories is much less overwhelming than scanning through the long list of charges on your bank statement. Secondly, a good money budgeting app will notify you of potential duplicate charges. The app is going to be able to recognize charges that look similar and point them out to you whereas your bank statement will not do that and it can be very easy to scan right past it when looking at your accounts.

Are budgeting apps helpful?

The best apps for personal budgeting will be extremely helpful in giving you an overall picture of your finances. Apps can be more beneficial because you can take them on the go. One of the main reasons I struggled with my finances was that I often had no idea where my money was going. An app can give you an accurate picture of where you are regularly. This will help you reach your goals more effectively. While some apps are free and some apps are paid, it can seem counterintuitive to spend money on a budgeting app when you are trying to watch your expenses. If the app allows you to be in better control of your finances, you may still end up saving a substantial amount of money. You have to weigh the pros and cons of your situation!

Best apps for budgeting Android

Thankfully most of the best apps for budgeting money are available on Android and iPhone. Here is the list of best android apps for budgeting.

- YNAB (You Need A Budget) – YNAB is a budgeting app that has you plan for where every dollar you bring in will go. Instead of taking a reactive approach to your money, you are proactive in giving every dollar a job. They offer a 34-day free trial and then either $11.99 a month or $84 a year for a subscription.

- Mint – A free app that will track your spending, balances, budget and even credit score.

- Simplifi by Quicken – Simplifi lets you track all of your bank accounts, loans, credit cards and investments. You can set up your own categories, limits, and spending plans among other things. Simplifi offers a 30 day free trial and then it is either $5.99 a month or $47.99 a year which comes out to $3.99 a month.

- PocketGaurd – This app shows you how much spendable money you have left after setting aside enough for bills, goals and necessities. You can also keep track of which categories are taking up too much of your funds. Set up debt payoff strategies and follow a schedule to meet your goals. You can link all of your banks, credit cards, loans and investments to track them in one place. PocketGuard also lets you track your bills and negotiate better rates on your cable, cell phone and other bills. PocketGuard has a free version or you can upgrade to PocketGuard Plus for $7.99 a month, $79.99 a year or $99.99 for a lifetime membership.

- Zeta – Zeta is one I wasn’t familiar with but it is advertised as a great app for couples and families. They offer joint cards and a budgeting app designed for couples. They also offer money challenges and guidance about combining finances and being on the same page with your partner. Zeta’s money manager is currently free

- EveryDollar – EveryDollar is an app created by Ramsey Solutions. This app helps you to track your income and expenses, customize your budget, create savings funds and track your payments towards bills and debt. There is a free option as well as a paid option that is $59.99 for 3 months after a 14 day free trial, $99.99 for 6 months after a 14 day free trial, or $129.99 for 12 months after a 14 day free trial.

Best iPhone budgeting apps

I am relisting all of the apps that were listed above purely so if people jump to iPhone apps from the table of contents above they won’t be confused. I am thankful that all of the home budgeting apps are available now on both iPhone and Android!

- YNAB (You Need A Budget) – YNAB is a budgeting app that has you plan ahead for where every dollar you bring in is going to go. Instead of taking a reactive approach to your money, you are proactive in giving every dollar a job. They offer an 34 day free trial and then it is either $11.99 a month or $84 a year for a subscription.

- Mint – A free app that will track your spending, balances, budget and even credit score.

- Simplifi by Quicken – Simplifi lets you track all of your bank accounts, loans, credit cards and investments. You can set up your own categories, limits, and spending plans among other things. Simplifi offers a 30 day free trial and then it is either $5.99 a month or $47.99 a year which comes out to $3.99 a month.

- PocketGaurd – This app shows you how much spendable money you have left after setting aside enough for bills, goals and necessities. You can also keep track of which categories are taking up too much of your funds. Set up debt payoff strategies and follow a schedule to meet your goals. You can link all of your banks, credit cards, loans and investments to track them in one place. PocketGuard also lets you track your bills and negotiate better rates on your cable, cell phone and other bills. PocketGuard has a free version or you can upgrade to PocketGuard Plus for $7.99 a month, $79.99 a year or $99.99 for a lifetime membership.

- Zeta – Zeta is one I wasn’t familiar with but it is advertised as a great app for couples and families. They offer joint cards and a budgeting app designed for couples. They also offer money challenges and guidance about combining finances and being on the same page with your partner. Zeta’s money manager is currently free

- EveryDollar – EveryDollar is an app created by Ramsey Solutions. This app helps you to track your income and expenses, customize your budget, create savings funds and track your payments towards bills and debt. There is a free option as well as a paid option that is $59.99 for 3 months after a 14 day free trial, $99.99 for 6 months after a 14 day free trial, or $129.99 for 12 months after a 14 day free trial.

Budget Apps Free

- Zeta – Zeta’s completely free Money Manager app “can be used by linking your accounts automatically or entering your information manually. You can add your various accounts (checking, saving, credit card, investing and even real-estate) which then allows us to provide you with an analysis of your finances each month. We connect your accounts with your significant other (while controlling how much you share) and crunch the numbers based on whether they’re personal or shared accounts. Then, we provide you with monthly insights into how your finances are tracking and what you can do to improve them.” – from Zeta’s website.

- PocketGaurd – PocketGuard Free allows you to track recurring income, bills, create category budgets and set goals. It also allows you to view insights into your budget.

- Mint – A free app that will track your spending, balances, budget and even credit score.

- EveryDollar – The free version of EveryDollar allows you to customize your budget, create savings funds, and track your debt payments.

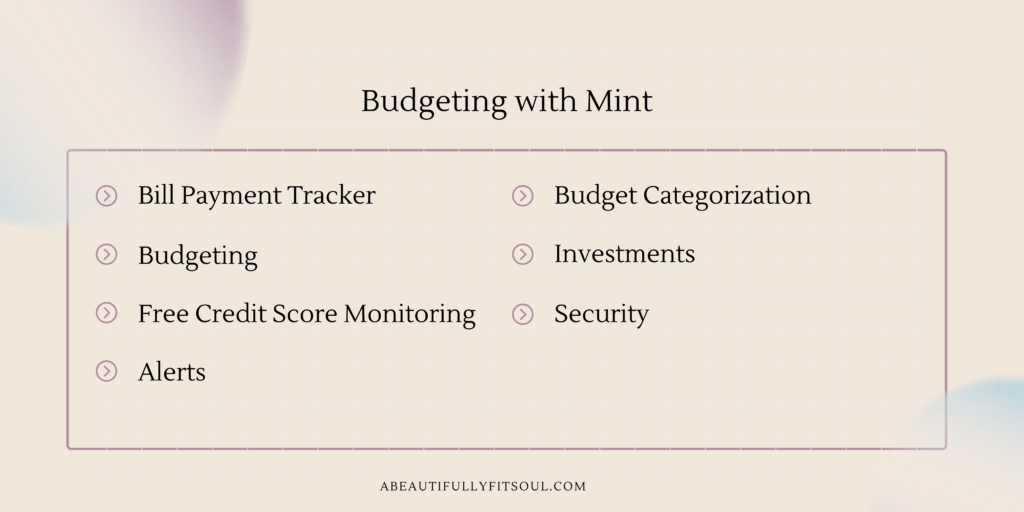

Budgeting with Mint

How it Works

Connect all of your accounts including cash, credit, loans and investments to get a complete financial picture. Track your accounts, bills and subsriptions. Get notified when your subscription amounts increase and when bills are due. Create custom budgets and Mint will automatically categorize your transactions. Get personalized insights to spend smarter, save more, and pay down debt. Mint will track your net worth, spending, and budgets to find opportunities to save.

Bill Payment Tracker

Track all of your bills, subscriptions, and fees in one place. Get notified when bills are due, if the prices increase, and if Mint detects any fees.

Budgeting

Set spending limits and get notified when you are getting close to overspending. Create unlimited categories to track the expenses that are specific to your life. Mint will give you recommendations when it finds areas that you could cut back on spending.

Free Credit Score Monitoring

Mint will monitor your credit score for free without negatively affecting your credit.

Alerts

Mint will notifiy you when balances are low or bills are due so you can avoid fees. Mint will also notify you of ATM fees and any unusual spending on your accounts so you are aware of where your money is going.

Budget Categorization

Mint has hundreds of categories for you to categorize your spending. You can also rename categories or create new ones so that it is completely customized to you. Once you categorize charges Mint will automatically apply those categories to the same future charges. You can also add tags to your charges to organize your transactions even further. Mint will automatically seperate certain charges like ATM withdrawals into cash and fees. You will need to seperate purchases from one transaction into different categories like groceries, clothing and household supplies.

Investments

Mint also offers portfolio tracking for your investments. Mint can help you catch hidden fees and keep track of all of your investment accounts .

Security

Mint uses passcodes, touch ID if chosen, multi-factor authentication and more to make sure all of your financial information is kept secure.

EveryDollar Budgeting

With EveryDollar you enter all of the money you have coming in for the month and then make a plan for every dollar. This is an example of zero-based budgeting. You can create and rearrange categories to fit your specific budgeting needs. You can create savings funds for anything you want or need to save for. Emergencies, big purchases, Christmas, and vacations are some examples. Fill in payment details and due dates for recurring payments. The app will also keep track of interest and payments while paying off debts.

EveryDollar does have a free version otherwise the paid version with additional features is either $59.99 for 3 months, $99.99 for 6 months or $129.99 for 12 months. All paid versions offer a 14 day free trial.

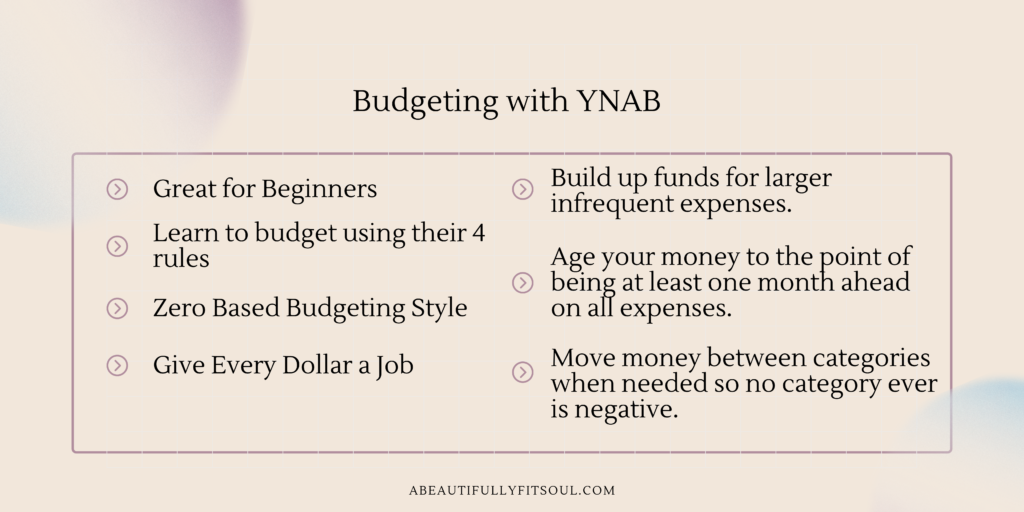

Budgeting with YNAB

YNAB is a great home budgeting app and claims to be different than other budgeting apps because it teaches you how to budget with their 4 rules. They take a very proactive approach at budgeting encouraging you to plan ahead for expenses that are coming up and setting money aside each month instead of a reactive approach of just entering what you’ve spent after you’ve spent it.

YNAB also follows the zero based budgeting style so you give each dollar a job as it comes into your account. The first rule is making a plan for every single dollar you earn and sticking to that plan!

The Second rule is finding your larger infrequent expenses and creating a target to build up that fund everymonth so when the time comes the money is already sitting there ready to go.

Rule three teaches you to be flexible with your budget so if you end up needing to spend a little more in one category you simply move money over from another category to cover it instead of allowing any category to go negative.

Rule 4 is all about ageing your money. YNAB teaches you that you ideally want to be spending money that is 30 or more days old. With spending less than you earn and building up those categories eventually you will get far enough ahead that you will be paying expenses with money that was earned the previous month instead of living ‘paycheck to paycheck’ and spending dollars the moment they come into your account.

YNAB is an incredibly simple way to break down budgeting and makes it easy for everyone. As far as I know it doesn’t deal with tracking your investments or things like that but is great for budgeting beginners or people who typically struggle with budgeting.

Simplifi vs. YNAB

Simple Budgeting Apps

In my opinion from both having used some of these apps and also from studying the information on their invidual websites I feel like all of the apps mentioned are simple to use. Like anything I feel that it is as simple as you want to make it. Depending how in depth you would like your tracking to be and how many accounts you have to keep track of. All of the apps seem to offer clear instructions and tutorials.

I will be coming out with another post in this series soon about the different tools for budgeting so if you are someone who prefers budgeting templates (whether printables or on the computer) or even budgeting planners I have tried ALL.THE.THINGS. Stay tuned for that and join my email list for updates.

If you are looking to really kick start your financial health and looking for a course I reccommend Jordan Page’s Budget Bootcamp. I love her helpful tips and the way she explains things. If you are looking for a great easy app to earn gift cards for scanning reciepts I recommend Fetch Rewards.

I also highly recommend Rakuten for earning cash back on purchases from major retailers. If you sign up you earn anywhere from $30-$40 cash back after your first qualifying purchase and they send you an actual check in the mail, no dealing with gift cards or points!

Please connect with me over on Instagram or in my free Facebook group to chat about any budgeting struggles, tricks or wins you may have!