Managing your money doesn’t have to be complicated or expensive. In fact, with the right tools, you can gain complete control over your finances without spending a dime. The digital age has brought us a wealth of budgeting apps designed to make tracking expenses, setting savings goals, and sticking to a financial plan easier than ever. In this post, we’ll explore the best free budgeting apps available today, each offering unique features to suit different lifestyles and financial needs. Whether you’re a seasoned saver or just starting your financial journey, these apps can help you build better habits and achieve your money goals with ease.

Table of Contents

What do budgeting apps do?

Budgeting apps are powerful tools designed to help you manage your money efficiently and stay on top of your financial goals. The best free budgeting apps offer features like expense tracking, income monitoring, and budget planning, all without costing you a penny. These apps categorize your spending, provide real-time insights, and often connect to your bank accounts for seamless tracking. Many also include features like bill reminders, savings goals, and even debt payoff planning. By using a budgeting app, you can gain a clear understanding of where your money is going, identify areas to cut back, and make informed financial decisions—all while keeping your financial goals within reach.

Are budgeting apps safe?

When it comes to managing your finances, safety is a top priority, and many people wonder if budgeting apps are truly secure. The good news is that most reputable budgeting apps employ advanced security measures to protect your personal and financial data. These include encryption protocols similar to those used by banks, secure authentication methods like two-factor authentication, and read-only access to your bank accounts to prevent unauthorized transactions. While the best free budgeting apps take these precautions seriously, it’s important to do your research before downloading. Look for apps with positive reviews, a transparent privacy policy, and partnerships with trusted financial institutions. By choosing a well-established app and practicing good cybersecurity habits, like using strong passwords and keeping your app updated, you can safely take advantage of the convenience and benefits these tools offer.

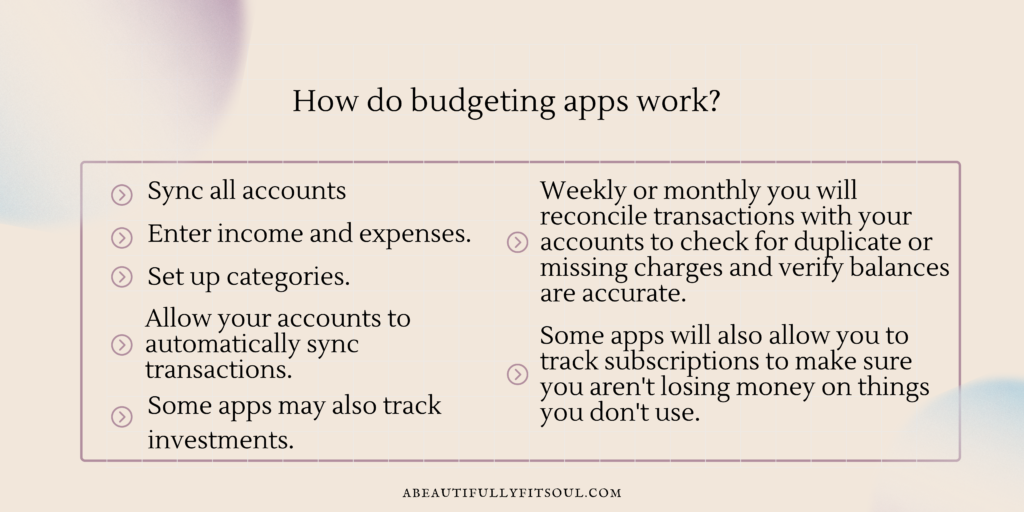

How do budgeting apps work?

Budgeting apps work by simplifying the process of tracking your income and expenses, helping you create and stick to a financial plan. Most apps allow you to link your bank accounts, credit cards, and other financial accounts securely, so they can automatically import and categorize your transactions. Others may require you to input your financial data manually. The best free budgeting apps analyze your spending habits and provide insights into where your money is going, enabling you to identify patterns and adjust your budget accordingly. Many apps also let you set financial goals, like saving for a vacation or paying off debt, and track your progress over time. With easy-to-use interfaces and visual tools like charts and graphs, budgeting apps make managing your money more accessible and less time-consuming.

Best Free Budgeting Apps

NerdWallet

NerdWallet is a free app that helps you keep track of your money and make smarter financial choices. It shows you how much you’re spending, helps you create a budget, and gives you tips to save more. It’s easy to use and even offers extra tools like checking your credit score or comparing financial products like credit cards. If you want a simple way to manage your money without spending anything, NerdWallet is a great choice!

EveryDollar

EveryDollar is a free app with a paid option that makes budgeting simple and easy to follow. It helps you plan your money by showing you what you have, what you spend, and what’s left for saving or other goals. You can set up a monthly budget in just a few minutes and track your spending to make sure you’re sticking to your plan. It’s great for anyone who wants a clear, straightforward way to manage their money and focus on what matters most.

RocketMoney

Rocket Money is a free app with a paid option that helps you keep track of your money and stay on budget. It shows you where your money is going, helps you plan your spending, and even finds subscriptions you might not be using so you can save more. It’s simple to use and gives you helpful tips to make smarter money decisions. If you want an easy way to manage your finances and cut down on unnecessary costs, Rocket Money is a great choice!

SoFI

Even though SoFi is a banking institution not a budgeting app I did want to add this one because I have been using and loving the way it helps me track my finances and credit score. You can also open a high-yield savings account with no minimum balance which is so important to have and earns you way more money than a regular savings acount! You can also earn rewards for various activties around banking which makes budgeting feel a little more like a game. A great motivator for the ADHD brain! When you open and fund a new checking or savings account you can get $25 free!

Tracking Subscriptions

Budgeting apps are excellent tools for tracking subscriptions, helping you avoid unexpected charges and keep your finances in check. Many of the best free budgeting apps automatically detect recurring payments from your bank or credit card transactions, such as streaming services, gym memberships, or app subscriptions. They provide a clear overview of all your active subscriptions in one place, making it easier to identify ones you no longer use or need. Some apps even send reminders for upcoming renewals or allow you to cancel subscriptions directly through the app. By keeping tabs on these recurring expenses, budgeting apps help you avoid wasteful spending and free up money for more important financial goals.

Apps Vs. Tracking Bank Statements

I feel budgeting apps are much more helpful than just looking through your bank account for a few reasons. First of all, having the charges divided into different categories is much less overwhelming than scanning through the long list of charges on your bank statement. Secondly, a good money budgeting app will notify you of potential duplicate charges. The app is going to be able to recognize charges that look similar and point them out to you whereas your bank statement will not do that and it can be very easy to scan right past it when looking at your accounts.

Are budgeting apps helpful?

The best free budgeting apps will be extremely helpful in giving you an overall picture of your finances. Apps can be more beneficial because you can take them on the go. One of the main reasons I struggled with my finances was that I often had no idea where my money was going. An app can give you an accurate picture of where you are regularly. This will help you reach your goals more effectively. While some apps are free and some apps are paid, it can seem counterintuitive to spend money on a budgeting app when you are trying to watch your expenses. If the app allows you to be in better control of your finances, you may still end up saving a substantial amount of money. You have to weigh the pros and cons of your situation!

I will be coming out with another post in this series soon about the different tools for budgeting so if you are someone who prefers budgeting templates (whether printables or on the computer) or even budgeting planners I have tried ALL.THE.THINGS. Stay tuned for that and join my email list for updates.

If you are looking to really kick start your financial health and looking for a course I reccommend Jordan Page’s Budget Bootcamp. I love her helpful tips and the way she explains things. If you are looking for a great easy app to earn gift cards for scanning reciepts I recommend Fetch Rewards.

I also highly recommend Rakuten for earning cash back on purchases from major retailers. If you sign up you earn anywhere from $30-$40 cash back after your first qualifying purchase and they send you an actual check in the mail, no dealing with gift cards or points!

Please connect with me over on Instagram or in my free Facebook group to chat about any budgeting struggles, tricks or wins you may have!