If you are like me and struggle with ADHD, money may feel confusing, stressful, or just hard. First of all, I want you to know something. You are not bad with money. You’re either trying to manage it with systems that weren’t built for your brain, or you are just trying to wing it because the other options feel too overwhelming. For the longest time, I felt so much shame around budgeting. I couldn’t quite explain why it never seemed to work for me, why I couldn’t visualize how much I could spend, or why credit cards felt helpful but also extremely problematic. Once I learned more about ADHD, so many of my money struggles finally made sense. I started to see how things like time blindness, impulsive spending, and forgetting what I’d already spent were really affecting my finances. The good news is ADHD budgeting doesn’t have to feel complicated or miserable. You just have to find ways to work with your brain instead of against it. Here are some tips for finding an ADHD-friendly budgeting system you can actually stick to.

Table of Contents

Why Budgeting Feels So Hard With ADHD

Traditional budgeting advice assumes your brain loves details, consistency, and long-term planning. ADHD brains? Not so much.

Here are some very real reasons budgeting feels overwhelming when you have ADHD:

- Time blindness – It’s hard to grasp how long it will take to pay something off. This is one I’ve often fallen for.

- Object permanence issues – If you can’t see the bill, it basically doesn’t exist. Out of sight, out of mind!

- Impulse or emotional spending – The instant hit of dopamine with impulse purchases is real. Emotions also play a role. I’ve often told myself, ‘I’m having a terrible day, I deserve this.’ Or ‘I’m having a great day, let’s celebrate!’

- Decision fatigue → Too many categories, apps, or rules = instant shutdown

- All-or-nothing thinking → One “mess-up” makes you want to quit entirely

None of this means you’re irresponsible, which is what I always told myself. It just means you need a different approach.

The ADHD Budgeting Mindset (This Part Matters)

Before we talk about any tips or tricks, we need to discuss mindset, because budgeting with ADHD only works if you are kind to yourself.

Here are a few rules I live by now:

- Simple beats detailed.

- Done is better than doing it ‘the right way.’

- Progress > perfection.

- Your budget is a tool, not a punishment

You’re allowed to adjust. You’re allowed to change systems. And you’re allowed to make budgeting easier than “the experts” say it should be.

Step 1: Choose a Budgeting System That Works With Your Brain

If you’ve ever tried to track every penny and quit within a week, same. That’s why ADHD budgeting works best when it’s simple and visual.

Some ADHD-friendly options:

- A simplified zero-based budget (every dollar has a job, but categories stay minimal)

- The 50/30/20 method if details overwhelm you

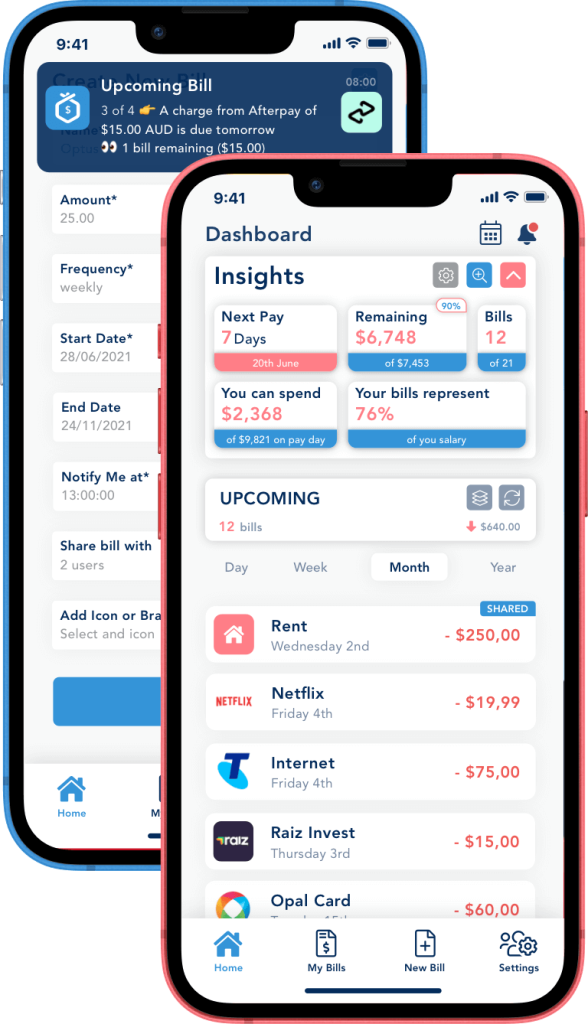

- Automatic budgeting apps that do the math for you

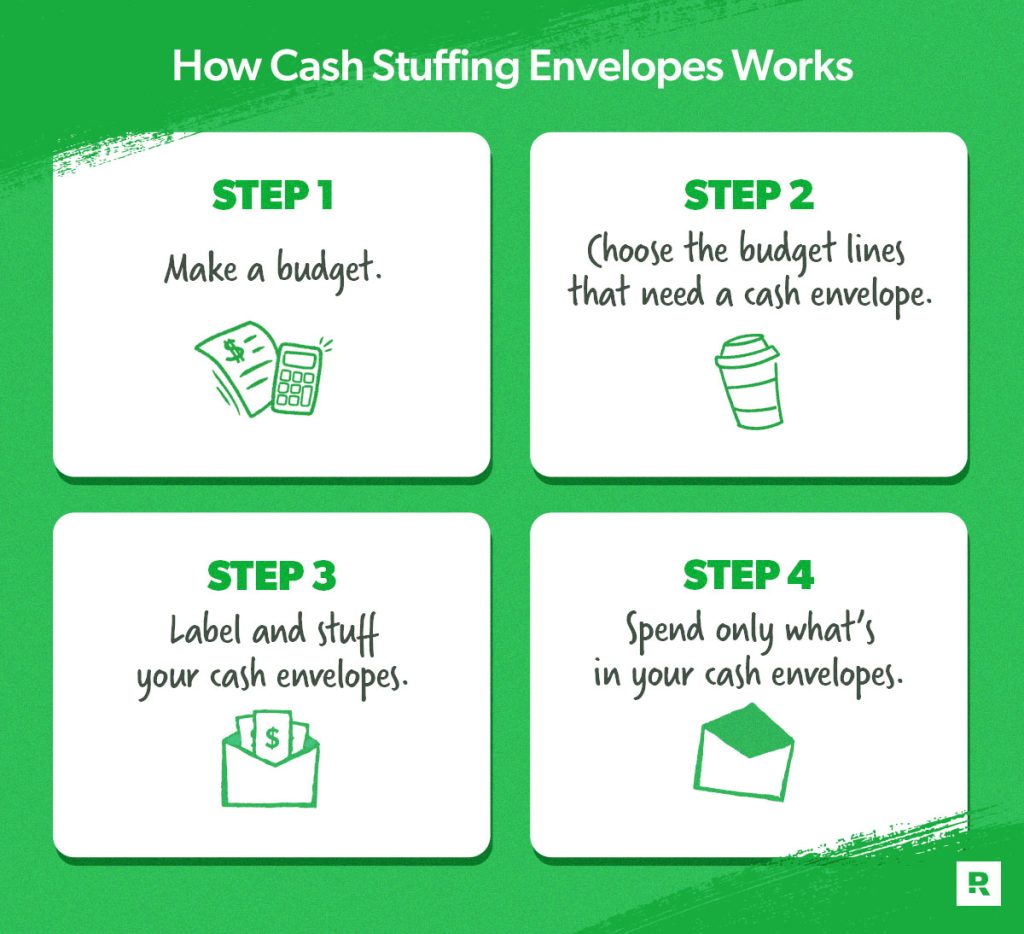

- Cash stuffing or envelope systems for visual, hands-on thinkers. This is a great way to have a visual reminder of how much you’re spending and how much you have left.

The best system is the one you’ll actually open again next week. That’s it. That’s the rule.

Step 2: Automate Everything You Possibly Can

Automation is an ADHD budgeting lifesaver.

Set up:

- Automatic bill pay for fixed expenses

- Automatic transfers to savings

- Automatic minimum debt payments

Every bill you automate is one less thing your brain has to remember, and fewer late fees (which are basically an ADHD tax none of us asked for).

If something can’t be automated, add it to your calendar with reminders. Your future self will thank you.

Step 3: Create Simple, Visual Money Categories

ADHD brains tend to do better when things are visible and limited.

Instead of 15 categories, try 5–7:

- Bills

- Groceries

- Fun money

- Gas

- Savings

- Miscellaneous

You can use:

- Color-coded categories

- Cash envelopes

- A printable tracker

- A notes app with emojis (seriously, it works)

If it feels fun or satisfying to look at, you’re more likely to keep using it.

Step 4: Do a Weekly 10-Minute Money Check-In

Long monthly budgeting sessions? Nope. That’s a recipe for avoidance.

Instead, try a weekly 10-minute check-in:

- Open your bank account

- Check balances

- Look at upcoming bills

- Adjust categories if needed

Make it cozy, coffee, candle, comfy chair. This isn’t about perfection. It’s just about staying aware.

Step 5: Build Spending Rules That Support You (Not Restrict You)

ADHD budgeting works better with gentle guidance, not strict rules.

A few ideas:

- The 24-hour rule for impulse purchases

- A dedicated fun money category (this one is non-negotiable)

- Personal triggers, like:

- Under $20 → wait 24 hours

- Over $50 → wait 48 hours

You’re not depriving yourself, you’re just giving your brain time to catch up.

Step 6: Track What Actually Matters (Ignore the Rest)

You don’t need to track every coffee or Target run to succeed.

Focus on:

- Bills

- Variable spending categories

- Savings progress

- Debt balances (if applicable)

Everything else is optional. If tracking something makes you quit entirely, let it go.

Step 7: Create ADHD-Proof Safeguards

This is where budgeting becomes easier in the long term.

Try:

- Low-balance alerts

- Bill reminders

- A “Money” folder on your phone for all financial apps

- Notifications instead of memory

The goal is to rely less on willpower and more on systems.

Helpful Tools for ADHD Budgeting

- Budgeting apps that automate tracking. The main one I have tried is YNAB.

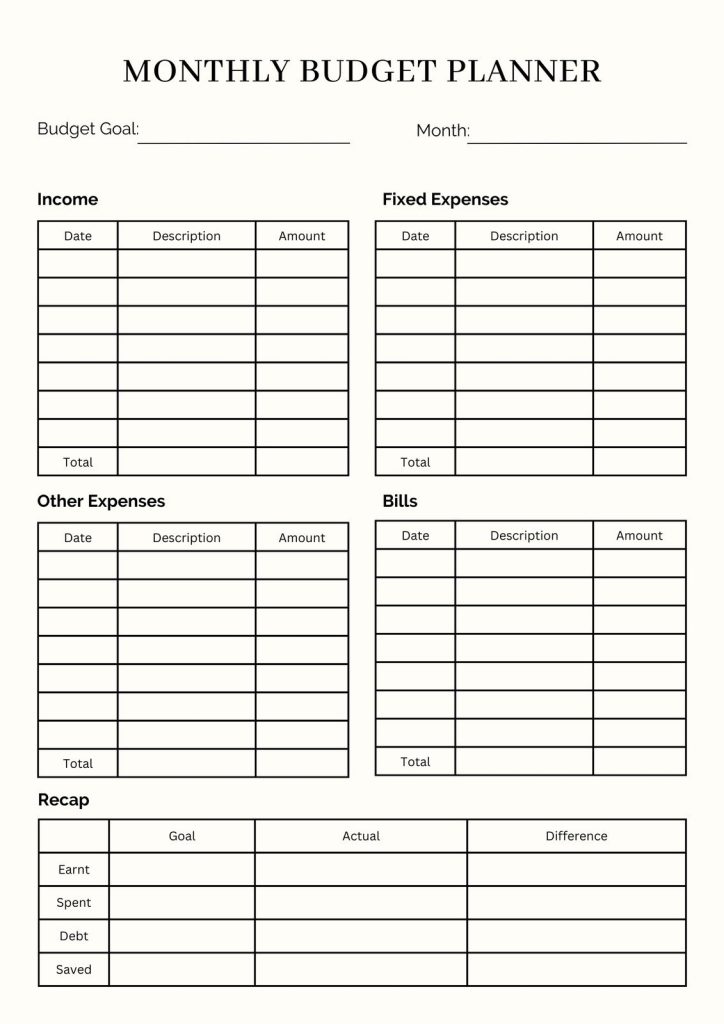

- Printable budget planners and checklists. You can find these on Etsy or download my free printable to get started!

- Cash envelopes or wallet dividers

- Habit trackers

- Browser extensions that help with impulse spending, like Pause.

If something makes budgeting feel lighter or more fun, it belongs in your system.

Final Thoughts: You Can Budget With ADHD

Budgeting with ADHD isn’t about becoming someone new; it’s about building systems that meet you where you are.

You’re allowed to:

- Start small

- Change methods

- Mess up and keep going

If money has felt like a source of shame or stress, I hope this helps you see that nothing is “wrong” with you. You just needed tools designed for your brain.

If you want more ADHD-friendly life tips, budgeting printables, and cozy encouragement, come hang out with me on Instagram or join my Facebook community. And if you’re ready to get started, grab my free budgeting printable to make this feel even easier.

You’re doing better than you think.